Viser opslag med etiketten olie. Vis alle opslag

Viser opslag med etiketten olie. Vis alle opslag

søndag den 23. oktober 2011

lørdag den 18. juni 2011

The Resource Curse: Uganda's Oil Will Probably Not Mean Prosperity for Its Impoverished Population.

"The discovery of oil in Africa has rarely brought about positive socio-economic outcomes. Indeed, quite the opposite is true: regions with an abundance of non-renewable sub-surface resources nearly always experience declining development and less economic growth than countries with fewer such resources.

Nigeria offers a disturbing example of this trend. Since production began in the mid 1960s, Nigeria has seen an oil bonanza worth more than $340 billion. But the economy remains in absolute tatters: more than 70% of Nigerians live in conditions of intractable poverty – earning less than a dollar a day – and the infant mortality rate is among the highest in the world. Indeed, Nigerians are significantly poorer today than they were at the start of the oil boom. Average incomes are less than one third what they were in 1980, and despite ballooning petroleum revenues per capita GDP remains at about 1965 levels. Similar problems plague Africa’s other major petroleum producers, like Chad, Angola, Gabon, and Equatorial Guinea."

Excerpted from the Foreign Policy in Focus article "Saving Uganda from Its Oil."

tirsdag den 29. marts 2011

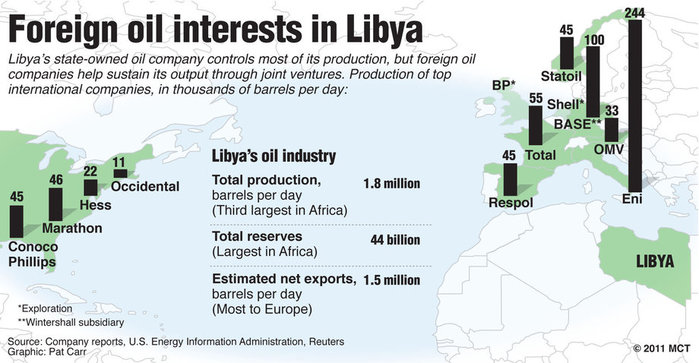

Foreign Oil Interests in Libya.

fredag den 9. januar 2009

The Problem of Cheap Oil

by Michael T. Klare

Only yesterday, it seems, we were bemoaning the high price of oil. Under the headline "Oil's Rapid Rise Stirs Talk of $200 a Barrel This Year," the July 7 issue of the Wall Street Journal warned that prices that high would put "extreme strains on large sectors of the U.S. economy." Today, oil, at over $40 a barrel, costs less than one-third what it did in July, and some economists have predicted that it could fall as low as $25 a barrel in 2009.

Prices that low -- and their equivalents at the gas pump -- will no doubt be viewed as a godsend by many hard-hit American consumers, even if they ensure severe economic hardship in oil-producing countries like Nigeria, Russia, Iran, Kuwait, and Venezuela that depend on energy exports for a large share of their national income. Here, however, is a simple but crucial reality to keep in mind: No matter how much it costs, whether it's rising or falling, oil has a profound impact on the world we inhabit -- and this will be no less true in 2009 than in 2008.

The main reason? In good times and bad, oil will continue to supply the largest share of the world's energy supply. For all the talk of alternatives, petroleum will remain the number one source of energy for at least the next several decades. According to December 2008 projections from the U.S. Department of Energy (DoE), petroleum products will still make up 38% of America's total energy supply in 2015; natural gas and coal only 23% each. Oil's overall share is expected to decline slightly as biofuels (and other alternatives) take on a larger percentage of the total, but even in 2030 -- the furthest the DoE is currently willing to project -- it will still remain the dominant fuel.

A similar pattern holds for the planet as a whole: Although biofuels and other renewable sources of energy are expected to play a growing role in the global energy equation, don't expect oil to be anything but the world's leading source of fuel for decades to come.

Keep your eye on the politics of oil and you'll always know a lot about what's actually happening on this planet. Low prices, as at present, are bad for producers, and so will hurt a number of countries that the U.S. government considers hostile, including Venezuela, Iran, and even that natural-gas-and-oil giant Russia. All of them have, in recent years, used their soaring oil income to finance political endeavors considered inimical to U.S. interests. However, dwindling prices could also shake the very foundations of oil allies like Mexico, Nigeria, and Saudi Arabia, which could experience internal unrest as oil revenues, and so state expenditures, decline.

No less important, diminished oil prices discourage investment in complex oil ventures like deep-offshore drilling, as well as investment in the development of alternatives to oil like advanced (non-food) biofuels. Perhaps most disastrously, in a cheap oil moment, investment in non-polluting, non-climate-altering alternatives like solar, wind, and tidal energy is also likely to dwindle. In the longer term, what this means is that, once a global economic recovery begins, we can expect a fresh oil price shock as future energy options prove painfully limited.

Clearly, there is no escaping oil's influence. Yet it's hard to know just what forms this influence will take in the year. Nevertheless, here are three provisional observations on oil's fate -- and so ours -- in the year ahead.

1. The Price of Oil Will Remain Low Until It Begins to Rise Again: I know, I know: this sounds totally inane. It's just that there's no other way to put it. The price of oil has essentially dropped through the floor because, in the past four months, demand collapsed due to the onset of a staggering global recession. It is not likely to approach the record levels of spring and summer 2008 again until demand picks up and/or the global oil supply is curbed dramatically. At this point, unfortunately, no crystal ball can predict just when either of those events will occur.

The contraction in international demand has indeed been stunning. After rising for much of last summer, demand plunged in the early fall by several hundred thousand barrels per day, producing a net decline for 2008 of 50,000 barrels per day. This year, the Department of Energy projects global demand to fall by a far more impressive 450,000 barrels per day -- "the first time in three decades that world consumption would decline in two consecutive years."

Needless to say, these declines were unexpected. Believing that international demand would continue to grow -- as had been the case in almost every year since the last big recession of 1980 -- the global oil industry steadily added to production capacity and was gearing up for more of the same in 2009 and beyond. Indeed, under intense pressure from the Bush administration, the Saudis had indicated last June that they would gradually add to their capacity until they reached an extra 2.5 million barrels per day.

Today, the industry is burdened with excess output and insufficient demand -- a surefire recipe for plunging oil prices. Even the December 17 decision by members of the Organization of the Petroleum Exporting Countries (OPEC) to reduce their collective output by 2.2 million barrels per day has failed to lead to a significant increase in prices. (Saudi Arabia's King Abdullah said recently that he considers $75 a barrel a "fair price" for oil.)

How long will the imbalance between demand and supply last? Until the middle of 2009, if not the end of the year, most analysts believe. Others suspect that a true global recovery will not even get under way until 2010, or later. It all depends on how deep and prolonged you expect the recession - or any coming depression -- to be.

A critical factor will be China's ability to absorb oil. After all, between 2002 and 2007, that country accounted for 35% of the total increase in world oil consumption -- and, according to the DoE, it is expected to claim at least another 24% of any global increase in the coming decade. The upsurge in Chinese consumption, combined with unremitting demand from older industrialized nations and significant price speculation on oil futures, largely explained the astronomical way prices were driven up until last summer. But with the Chinese economy visibly faltering, such projections no longer seem valid. Many analysts now predict that a sharp drop-off in Chinese demand will only accelerate the downward journey of global energy prices. Under these conditions, an early price turnaround appears increasingly unlikely.

2. When Prices Do Rise Again, They Will Rise Sharply: At present, the world enjoys the (relatively) unfamiliar prospect of a global oil-production surplus, but there's a problematic aspect to this. As long as prices remain low, oil companies have no incentive to invest in costly new production ventures, which means no new capacity is being added to global inventories, while available capacity continues to be drained. Simply put, what this means is that, when demand begins to surge again, global output is likely to prove inadequate. As Ed Crooks of the Financial Times has suggested, "The plunging oil price is like a dangerously addictive painkiller: short-term relief is being provided at a cost of serious long-term harm."

Signs of a slowdown in oil-output investment are already multiplying fast. Saudi Arabia, for example, has announced delays in four major energy projects in what appears to be a broad retreat from its promise to increase future output. Among the projects being delayed are a $1.2 billion venture to restart the historic Damman oil field, development of the 900,000 barrel per day Manifa oil field, and construction of new refineries at Yanbu and Jubail. In each case, the delays are being attributed to reduced international demand. "We are going back to our partners and discussing with them the new economic circumstances," explained Kaled al-Buraik, an official of Saudi Aramco.

In addition, most "easy oil" reservoirs have now been exhausted, which means that virtually all remaining global reserves are going to be of the "tough oil" variety. These require extraction technology far too costly to be profitable at a moment when the per barrel price remains under $50. Principal among these are exploitation of the tar sands of Canada and of deep offshore fields in the Gulf of Mexico, the Gulf of Guinea, and waters off Brazil. While such potential reserves undoubtedly harbor significant supplies of petroleum, they won't return a profit until the price of oil reaches $80 or more per barrel -- nearly twice what it is fetching today. Under these circumstances, it is hardly surprising that the oil majors are canceling or postponing plans for new projects in Canada and these offshore locations.

"Low oil prices are very dangerous for the world economy," commented Mohamed Bin Dhaen Al Hamli, the United Arab Emirates' energy minister, at a London oil-industry conference in October. With prices dropping, he noted, "a lot of projects that are in the pipeline are going to be reassessed."

With industry cutting back on investment, there will be less capacity to meet rising demand when the world economy does rebound. At that time, expect the present situation to change with predictably startling rapidity, as rising demand suddenly finds itself chasing inadequate supply in an energy-deficit world.

When this will occur and how high oil prices will then climb cannot, of course, be known, but expect gas-pump shock. It's possible that the energy shock to come will be no less fierce than the present global recession and energy price collapse. The Department of Energy, in its most recent projections, predicts that oil will reach an average of $78 per barrel in 2010, $110 in 2015, and $116 in 2020. Other analysts suggest that prices could go much higher much faster, especially if demand picks up quickly and the oil companies are slow to restart projects now being put on hold.

3. Low Oil Prices Like High Ones Will Have Significant Worldwide Political Implications: The steady run up in oil prices between 2003 and 2008 was the result of a sharp increase in global demand as well as a perception that the international energy industry was having difficulty bringing sufficient new sources of supply on line. Many analysts spoke of the imminent arrival of "peak oil," the moment at which global output would commence an irreversible decline. All this fueled fierce efforts by major consuming nations to secure control over as many foreign sources of petroleum as they could, including frenzied attempts by U.S., European, and Chinese firms to gobble up oil concessions in Africa and the Caspian Sea basin -- the theme of my latest book, Rising Powers, Shrinking Planet.

With the plunge in oil prices and a growing sense (however temporary) of oil plenty, this dog-eat-dog competition is likely to abate. The current absence of intense competition does not, however, mean that oil prices will cease to have an impact on global politics. Far from it. In fact, low prices are just as likely to roil the international landscape, only in new ways. While competition among consuming states may lessen, negative political conditions within producing nations are sure to be magnified.

Many of these nations, including Angola, Iran, Iraq, Mexico, Nigeria, Russia, Saudi Arabia, and Venezuela, among others, rely on income from oil exports for a large part of their government expenditures, using this money to finance health and education, infrastructure improvements, food and energy subsidies, and social welfare programs. Soaring energy prices, for instance, allowed many producer countries to reduce high youth unemployment -- and so potential unrest. As prices come crashing down, governments are already being forced to cut back on programs that aid the poor, the middle class, and the unemployed, which is already producing waves of instability in many parts of the world.

Russia's state budget, for example, remains balanced only when oil prices stay at or above $70 per barrel. With government income dwindling, the Kremlin has been forced to dig into accumulated reserves in order to meet its obligations and prop up sinking companies as well as the sinking ruble. The nation hailed as an energy giant is running out of money quickly. Unemployment is on the rise, and many firms are reducing work hours to save cash. Although Prime Minister Vladimir Putin remains popular, the first signs of public discontent have begun to appear, including scattered protests against increased tariffs on imported goods, rising public transit fees, and other such measures.

The decline in oil prices has been particularly damaging to natural gas behemoth Gazprom, Russia's biggest company and the source (in good times) of approximately one quarter of government tax income. Because the price of natural gas is usually pegged to that of oil, declining oil prices have hit the company hard: last summer, CEO Alexei Miller estimated its market value at $360 billion; today, it's $85 billion.

In the past, the Russians have used gas shut-offs to neighboring states to extend their political clout. Given the steep drop in gas prices, however, Gazprom's January 1st decision to sever gas supplies to Ukraine (for failure to pay for $1.5 billion in past deliveries) is, at least in part, finance-based. Though the decision has triggered energy shortages in Europe -- 25% of its natural gas arrives via Gazprom-fueled pipelines that traverse Ukraine -- Moscow shows no sign of backing down in the price dispute. "They do need the money," observed Chris Weafer of UralSib Bank in Moscow. "That is the bottom line."

Plunging oil prices are also expected to place severe strains on the governments of Iran, Saudi Arabia, and Venezuela, all of which benefited from the record prices of the past few years to finance public works, subsidize basic necessities, and generate employment. Like Russia, these countries adopted expansive budgets on the assumption that a world of $70 or more per barrel gas prices would continue indefinitely. Now, like other affected producers, they must dip into accumulated reserves, borrow at a premium, and cut back on social spending -- all of which risk a rise in political opposition and unrest at home.

The government of Iran, for example, has announced plans to eliminate subsidies on energy (gasoline now costs 36 cents per gallon) -- a move expected to spark widespread protests in a country where unemployment rates and living costs are rising precipitously. The Saudi government has promised to avoid budget cuts for the time being by drawing on accumulated reserves, but unemployment is growing there as well.

Diminished spending in oil-producing states like Kuwait, Saudi Arabia, and the United Arab Emirates will also affect non-producing countries like Egypt, Jordan, and Yemen because young men from these countries migrate to the oil kingdoms when times are flush in search of higher-paying jobs. When times are rough, however, they are the first to be laid off and are often sent back to their homelands where few jobs await them.

All this is occurring against the backdrop of an upsurge in the popularity of Islam, including its more militant forms that reject the "collaborationist" politics of pro-U.S. regimes like those of Hosni Mubarak of Egypt and King Abdullah II of Jordan. Combine this with the recent devastating Israeli air attacks on, and ground invasion of, Gaza as well as the seemingly lukewarm response of moderate Arab regimes to the plight of the 1.5 million Palestinians trapped in that tiny strip of land, and the stage may be set for a major upsurge in anti-government unrest and violence. If so, no one will see this as oil-related, and yet that, in part, is what it will be.

In the context of a planet caught in the grip of a fierce economic downturn, other stormy energy scenarios involving key oil-producing countries are easy enough to imagine. When and where they will arise cannot be foreseen, but such eruptions are only likely to make any future era of rising energy prices all that much more difficult. And, indeed, prices will eventually rise again, perhaps some year soon, swiftly and to new record heights. At that point, we will be confronted with the sort of problems we faced in the spring and summer of 2008, when raging demand and inadequate supply drove petroleum costs ever skyward. In the meantime, it's important to remember that, even with prices as low as they are, we cannot escape the consequences of our addiction to oil.

© 2009 TomDispatch.com

Michael T. Klare is the Five College Professor of Peace and World Security Studies at Hampshire College in Amherst, Massachusetts, and the author of Blood and Oil: The Dangers and Consequences of America's Growing Dependence on Imported Petroleum. A documentary version of that book is available at bloodandoilmovie.com. His newest book, Rising Powers, Shrinking Planet: The New Geopolitics of Energy, was recently published by Metropolitan Books.

Only yesterday, it seems, we were bemoaning the high price of oil. Under the headline "Oil's Rapid Rise Stirs Talk of $200 a Barrel This Year," the July 7 issue of the Wall Street Journal warned that prices that high would put "extreme strains on large sectors of the U.S. economy." Today, oil, at over $40 a barrel, costs less than one-third what it did in July, and some economists have predicted that it could fall as low as $25 a barrel in 2009.

Prices that low -- and their equivalents at the gas pump -- will no doubt be viewed as a godsend by many hard-hit American consumers, even if they ensure severe economic hardship in oil-producing countries like Nigeria, Russia, Iran, Kuwait, and Venezuela that depend on energy exports for a large share of their national income. Here, however, is a simple but crucial reality to keep in mind: No matter how much it costs, whether it's rising or falling, oil has a profound impact on the world we inhabit -- and this will be no less true in 2009 than in 2008.

The main reason? In good times and bad, oil will continue to supply the largest share of the world's energy supply. For all the talk of alternatives, petroleum will remain the number one source of energy for at least the next several decades. According to December 2008 projections from the U.S. Department of Energy (DoE), petroleum products will still make up 38% of America's total energy supply in 2015; natural gas and coal only 23% each. Oil's overall share is expected to decline slightly as biofuels (and other alternatives) take on a larger percentage of the total, but even in 2030 -- the furthest the DoE is currently willing to project -- it will still remain the dominant fuel.

A similar pattern holds for the planet as a whole: Although biofuels and other renewable sources of energy are expected to play a growing role in the global energy equation, don't expect oil to be anything but the world's leading source of fuel for decades to come.

Keep your eye on the politics of oil and you'll always know a lot about what's actually happening on this planet. Low prices, as at present, are bad for producers, and so will hurt a number of countries that the U.S. government considers hostile, including Venezuela, Iran, and even that natural-gas-and-oil giant Russia. All of them have, in recent years, used their soaring oil income to finance political endeavors considered inimical to U.S. interests. However, dwindling prices could also shake the very foundations of oil allies like Mexico, Nigeria, and Saudi Arabia, which could experience internal unrest as oil revenues, and so state expenditures, decline.

No less important, diminished oil prices discourage investment in complex oil ventures like deep-offshore drilling, as well as investment in the development of alternatives to oil like advanced (non-food) biofuels. Perhaps most disastrously, in a cheap oil moment, investment in non-polluting, non-climate-altering alternatives like solar, wind, and tidal energy is also likely to dwindle. In the longer term, what this means is that, once a global economic recovery begins, we can expect a fresh oil price shock as future energy options prove painfully limited.

Clearly, there is no escaping oil's influence. Yet it's hard to know just what forms this influence will take in the year. Nevertheless, here are three provisional observations on oil's fate -- and so ours -- in the year ahead.

1. The Price of Oil Will Remain Low Until It Begins to Rise Again: I know, I know: this sounds totally inane. It's just that there's no other way to put it. The price of oil has essentially dropped through the floor because, in the past four months, demand collapsed due to the onset of a staggering global recession. It is not likely to approach the record levels of spring and summer 2008 again until demand picks up and/or the global oil supply is curbed dramatically. At this point, unfortunately, no crystal ball can predict just when either of those events will occur.

The contraction in international demand has indeed been stunning. After rising for much of last summer, demand plunged in the early fall by several hundred thousand barrels per day, producing a net decline for 2008 of 50,000 barrels per day. This year, the Department of Energy projects global demand to fall by a far more impressive 450,000 barrels per day -- "the first time in three decades that world consumption would decline in two consecutive years."

Needless to say, these declines were unexpected. Believing that international demand would continue to grow -- as had been the case in almost every year since the last big recession of 1980 -- the global oil industry steadily added to production capacity and was gearing up for more of the same in 2009 and beyond. Indeed, under intense pressure from the Bush administration, the Saudis had indicated last June that they would gradually add to their capacity until they reached an extra 2.5 million barrels per day.

Today, the industry is burdened with excess output and insufficient demand -- a surefire recipe for plunging oil prices. Even the December 17 decision by members of the Organization of the Petroleum Exporting Countries (OPEC) to reduce their collective output by 2.2 million barrels per day has failed to lead to a significant increase in prices. (Saudi Arabia's King Abdullah said recently that he considers $75 a barrel a "fair price" for oil.)

How long will the imbalance between demand and supply last? Until the middle of 2009, if not the end of the year, most analysts believe. Others suspect that a true global recovery will not even get under way until 2010, or later. It all depends on how deep and prolonged you expect the recession - or any coming depression -- to be.

A critical factor will be China's ability to absorb oil. After all, between 2002 and 2007, that country accounted for 35% of the total increase in world oil consumption -- and, according to the DoE, it is expected to claim at least another 24% of any global increase in the coming decade. The upsurge in Chinese consumption, combined with unremitting demand from older industrialized nations and significant price speculation on oil futures, largely explained the astronomical way prices were driven up until last summer. But with the Chinese economy visibly faltering, such projections no longer seem valid. Many analysts now predict that a sharp drop-off in Chinese demand will only accelerate the downward journey of global energy prices. Under these conditions, an early price turnaround appears increasingly unlikely.

2. When Prices Do Rise Again, They Will Rise Sharply: At present, the world enjoys the (relatively) unfamiliar prospect of a global oil-production surplus, but there's a problematic aspect to this. As long as prices remain low, oil companies have no incentive to invest in costly new production ventures, which means no new capacity is being added to global inventories, while available capacity continues to be drained. Simply put, what this means is that, when demand begins to surge again, global output is likely to prove inadequate. As Ed Crooks of the Financial Times has suggested, "The plunging oil price is like a dangerously addictive painkiller: short-term relief is being provided at a cost of serious long-term harm."

Signs of a slowdown in oil-output investment are already multiplying fast. Saudi Arabia, for example, has announced delays in four major energy projects in what appears to be a broad retreat from its promise to increase future output. Among the projects being delayed are a $1.2 billion venture to restart the historic Damman oil field, development of the 900,000 barrel per day Manifa oil field, and construction of new refineries at Yanbu and Jubail. In each case, the delays are being attributed to reduced international demand. "We are going back to our partners and discussing with them the new economic circumstances," explained Kaled al-Buraik, an official of Saudi Aramco.

In addition, most "easy oil" reservoirs have now been exhausted, which means that virtually all remaining global reserves are going to be of the "tough oil" variety. These require extraction technology far too costly to be profitable at a moment when the per barrel price remains under $50. Principal among these are exploitation of the tar sands of Canada and of deep offshore fields in the Gulf of Mexico, the Gulf of Guinea, and waters off Brazil. While such potential reserves undoubtedly harbor significant supplies of petroleum, they won't return a profit until the price of oil reaches $80 or more per barrel -- nearly twice what it is fetching today. Under these circumstances, it is hardly surprising that the oil majors are canceling or postponing plans for new projects in Canada and these offshore locations.

"Low oil prices are very dangerous for the world economy," commented Mohamed Bin Dhaen Al Hamli, the United Arab Emirates' energy minister, at a London oil-industry conference in October. With prices dropping, he noted, "a lot of projects that are in the pipeline are going to be reassessed."

With industry cutting back on investment, there will be less capacity to meet rising demand when the world economy does rebound. At that time, expect the present situation to change with predictably startling rapidity, as rising demand suddenly finds itself chasing inadequate supply in an energy-deficit world.

When this will occur and how high oil prices will then climb cannot, of course, be known, but expect gas-pump shock. It's possible that the energy shock to come will be no less fierce than the present global recession and energy price collapse. The Department of Energy, in its most recent projections, predicts that oil will reach an average of $78 per barrel in 2010, $110 in 2015, and $116 in 2020. Other analysts suggest that prices could go much higher much faster, especially if demand picks up quickly and the oil companies are slow to restart projects now being put on hold.

3. Low Oil Prices Like High Ones Will Have Significant Worldwide Political Implications: The steady run up in oil prices between 2003 and 2008 was the result of a sharp increase in global demand as well as a perception that the international energy industry was having difficulty bringing sufficient new sources of supply on line. Many analysts spoke of the imminent arrival of "peak oil," the moment at which global output would commence an irreversible decline. All this fueled fierce efforts by major consuming nations to secure control over as many foreign sources of petroleum as they could, including frenzied attempts by U.S., European, and Chinese firms to gobble up oil concessions in Africa and the Caspian Sea basin -- the theme of my latest book, Rising Powers, Shrinking Planet.

With the plunge in oil prices and a growing sense (however temporary) of oil plenty, this dog-eat-dog competition is likely to abate. The current absence of intense competition does not, however, mean that oil prices will cease to have an impact on global politics. Far from it. In fact, low prices are just as likely to roil the international landscape, only in new ways. While competition among consuming states may lessen, negative political conditions within producing nations are sure to be magnified.

Many of these nations, including Angola, Iran, Iraq, Mexico, Nigeria, Russia, Saudi Arabia, and Venezuela, among others, rely on income from oil exports for a large part of their government expenditures, using this money to finance health and education, infrastructure improvements, food and energy subsidies, and social welfare programs. Soaring energy prices, for instance, allowed many producer countries to reduce high youth unemployment -- and so potential unrest. As prices come crashing down, governments are already being forced to cut back on programs that aid the poor, the middle class, and the unemployed, which is already producing waves of instability in many parts of the world.

Russia's state budget, for example, remains balanced only when oil prices stay at or above $70 per barrel. With government income dwindling, the Kremlin has been forced to dig into accumulated reserves in order to meet its obligations and prop up sinking companies as well as the sinking ruble. The nation hailed as an energy giant is running out of money quickly. Unemployment is on the rise, and many firms are reducing work hours to save cash. Although Prime Minister Vladimir Putin remains popular, the first signs of public discontent have begun to appear, including scattered protests against increased tariffs on imported goods, rising public transit fees, and other such measures.

The decline in oil prices has been particularly damaging to natural gas behemoth Gazprom, Russia's biggest company and the source (in good times) of approximately one quarter of government tax income. Because the price of natural gas is usually pegged to that of oil, declining oil prices have hit the company hard: last summer, CEO Alexei Miller estimated its market value at $360 billion; today, it's $85 billion.

In the past, the Russians have used gas shut-offs to neighboring states to extend their political clout. Given the steep drop in gas prices, however, Gazprom's January 1st decision to sever gas supplies to Ukraine (for failure to pay for $1.5 billion in past deliveries) is, at least in part, finance-based. Though the decision has triggered energy shortages in Europe -- 25% of its natural gas arrives via Gazprom-fueled pipelines that traverse Ukraine -- Moscow shows no sign of backing down in the price dispute. "They do need the money," observed Chris Weafer of UralSib Bank in Moscow. "That is the bottom line."

Plunging oil prices are also expected to place severe strains on the governments of Iran, Saudi Arabia, and Venezuela, all of which benefited from the record prices of the past few years to finance public works, subsidize basic necessities, and generate employment. Like Russia, these countries adopted expansive budgets on the assumption that a world of $70 or more per barrel gas prices would continue indefinitely. Now, like other affected producers, they must dip into accumulated reserves, borrow at a premium, and cut back on social spending -- all of which risk a rise in political opposition and unrest at home.

The government of Iran, for example, has announced plans to eliminate subsidies on energy (gasoline now costs 36 cents per gallon) -- a move expected to spark widespread protests in a country where unemployment rates and living costs are rising precipitously. The Saudi government has promised to avoid budget cuts for the time being by drawing on accumulated reserves, but unemployment is growing there as well.

Diminished spending in oil-producing states like Kuwait, Saudi Arabia, and the United Arab Emirates will also affect non-producing countries like Egypt, Jordan, and Yemen because young men from these countries migrate to the oil kingdoms when times are flush in search of higher-paying jobs. When times are rough, however, they are the first to be laid off and are often sent back to their homelands where few jobs await them.

All this is occurring against the backdrop of an upsurge in the popularity of Islam, including its more militant forms that reject the "collaborationist" politics of pro-U.S. regimes like those of Hosni Mubarak of Egypt and King Abdullah II of Jordan. Combine this with the recent devastating Israeli air attacks on, and ground invasion of, Gaza as well as the seemingly lukewarm response of moderate Arab regimes to the plight of the 1.5 million Palestinians trapped in that tiny strip of land, and the stage may be set for a major upsurge in anti-government unrest and violence. If so, no one will see this as oil-related, and yet that, in part, is what it will be.

In the context of a planet caught in the grip of a fierce economic downturn, other stormy energy scenarios involving key oil-producing countries are easy enough to imagine. When and where they will arise cannot be foreseen, but such eruptions are only likely to make any future era of rising energy prices all that much more difficult. And, indeed, prices will eventually rise again, perhaps some year soon, swiftly and to new record heights. At that point, we will be confronted with the sort of problems we faced in the spring and summer of 2008, when raging demand and inadequate supply drove petroleum costs ever skyward. In the meantime, it's important to remember that, even with prices as low as they are, we cannot escape the consequences of our addiction to oil.

© 2009 TomDispatch.com

Michael T. Klare is the Five College Professor of Peace and World Security Studies at Hampshire College in Amherst, Massachusetts, and the author of Blood and Oil: The Dangers and Consequences of America's Growing Dependence on Imported Petroleum. A documentary version of that book is available at bloodandoilmovie.com. His newest book, Rising Powers, Shrinking Planet: The New Geopolitics of Energy, was recently published by Metropolitan Books.

Etiketter:

michael klare,

olie

mandag den 8. december 2008

'2025' Report: A World of Resource Strife

Michael Klare | December 2, 2008

A new report by the National Intelligence Council (NIC) on the emerging strategic landscape, "Global Trends 2025," has attracted worldwide attention because it forecasts a future environment in which the United States wields less power than it does today and must contend with a constellation of other, newly ambitious great powers. "Although the United States is likely to remain the single most important actor," the report notes, "the United States' relative strength — even in the military realm — will decline and U.S. leverage will become more constrained." Of all the many revealing findings in the study, this has been the most widely quoted.

That the United States is likely to experience a decline in its strength relative to other great powers over the next 10 to 15 years is, of course, an observation bound to attract keen attention around the world, where criticism of U.S. foreign policy — over the Iraq War, the handling of the war on terror, our failure to sign the Kyoto Protocol on climate change — remains strong. The fact that "Global Trends 2025" emanated from a U.S. government agency — the NIC is part of the "national intelligence community" and reports to the Director of National Intelligence — lends additional weight to its findings. Still, when all is said and done, it's hardly surprising that professional analysts would come to this conclusion, given the enormous toll on America's military and economic resources taken by five-and-half years of fighting in Iraq and the accompanying loss to our influence, prestige, and goodwill abroad.

Climate and Competition

Far more striking and original, I believe, is the report's emphasis on the role of climate change and resource competition in the world of 2025 and beyond. Until now, these issues have appeared solely on the margins of U.S. strategic and intelligence studies. Now, for the first time, they have moved front and center.

"Resource issues will gain prominence on the international agenda," the NIC report notes. "Unprecedented global economic growth — positive in so many other regards — will continue to put pressure on a number of highly strategic resources, including energy, food, and water, and demand is projected to outstrip easily available supplies over the next decade or so."

The likely future availability of energy and water receives especially close attention. Oil, in particular, is seen as being at risk of failing to meet anticipated world requirements: "Non-OPEC liquid hydrocarbon production — crude oil, natural gas liquids, and unconventionals such as tar sands — will not grow commensurate with demand. Oil and gas production of many traditional energy producers already is declining…Countries capable of significantly expanding production will dwindle; oil and gas production will be concentrated in unstable areas." The bottom line: global oil supplies will be inadequate to satisfy demand, and importing nations will be forced to consume less and/or speed the production of alternatives.

Water scarcity is seen as an equally significant problem: "Lack of access to stable supplies of water is reaching critical proportions, and the problem will worsen because of rapid urbanization worldwide and the roughly 1.2 billion persons to be added [to the world's population] over the next 20 years." At present, we are told, some 600 million people in 21 countries are suffering from inadequate water supplies; by 2025, an estimated 1.4 billion people in 36 countries will face this peril.

Global warming will further exacerbate resource pressures, especially with respect to water and food. Although the impact of climate change will vary from region to region and cannot be predicted with precision, "a number of regions will begin to suffer harmful effects, particularly water scarcity and loss of agricultural production." Some areas will suffer more than others, "with declines disproportionately concentrated in developing countries, particularly those in sub-Saharan Africa." For many of these countries, "decreased agricultural output will be devastating because agriculture accounts for a large share of their economies and many citizens live close to subsistence levels."

Resource Wars

That resource scarcity and climate change will become increasingly severe in the decades ahead are hardly novel observations — many "peak oil" and environmental groups have been saying the same thing for years. But the NIC report takes this one step further by describing how these phenomena will intrude into international affairs and could provide the spark for armed violence. Increased scarcity, it suggests, could lead to greater efforts by states to secure control over overseas sources of energy and other key resources, producing geopolitical struggles among the major energy-deficit nations and possibly provoking all-out war.

"The rising energy demands of growing populations and economies may bring into question the availability, reliability, and affordability of energy supplies," the report notes. "Such a situation would heighten tensions between states competing for limited resources…In the worst case this could lead to interstate conflicts if government leaders deem assured access to energy resources to be essential to maintaining domestic stability and the survival of the regime."

Even in the absence of major interstate conflict, the report argues, growing competition for dwindling energy supplies could lead to heightened tensions, internal conflict, and terrorism. "Even actions short of war will have important geopolitical implications as states undertake strategies to hedge against the possibility that existing energy supplies will not meet rising demands." For example, "energy-deficient states may employ transfers of arms and sensitive technologies and the promise of a political and military alliance as inducements to establish strategic relationships with energy-producing states." Such relationships are already emerging in Central Asia, where China, Russia, and the United States are all competing for access to and control over the region's oil and gas reserves.

The growing concentration of wealth in the hands of petro-elites in places like Angola, Azerbaijan, Kazakhstan, and Nigeria will be another source of potential conflict. Because such elites rarely allocate oil revenues on an equitable basis or allow for a democratic transfer of power, any alteration in national governance (and the distribution of wealth) is likely to be accompanied by violence — often in the form of attacks on pipelines, refineries, and other oil-industry infrastructure. This, in turn, could invite "military intervention by outside powers to stabilize energy flows."

Several areas of the world are likely to figure in energy conflicts of this sort, especially Sub-Saharan Africa, the Middle East, and Central Asia. Each is the site of overlapping lines of conflict produced by a combination of ethnic and religious schisms, internal disputes over the allocation of resource revenues, and the contending geopolitical interests of the major powers. Under these circumstances, it would not take much for a minor skirmish — such as that between Georgia and Russia last August — to escalate into something much greater.

Water and land scarcity brought about or exacerbated by climate change could also trigger armed conflict, suggests the NIC report, although mostly of the internal sort. "Climate change is unlikely to trigger interstate war, but it could lead to increasingly heated interstate recriminations and possibly to low-level armed conflicts." A particular danger zone is the Himalayan region, where the ongoing melting of major glaciers is expected to diminish the annual flow of vital rivers in Bangladesh, China, India, and Pakistan — many of them shared by two or more of these countries and a perennial source of friction among them.

Clusters of Hostility

Terrorist violence will also be spurred by the struggle over critical resources. As climate change and water scarcity renders many rural areas uninhabitable — especially in high-population-growth areas of North Africa, the Middle East, and Asia — hundreds of millions of unemployed young men will pour into the sprawling mega-cities of the developing world, often facing unfriendly reception from the original inhabitants of these areas (who often will be of another religion or ethnicity). Some of these desperate, bitter young men will be drawn to crime; others to militant ideologies and movements.

"As long as turmoil and societal disruptions, generated by resource scarcities, poor governance, ethnic rivalries, or environmental degradation, increase in the Middle East, conditions will remain conducive to the spread of radicalism and insurgencies," the report concludes. And these clusters of hostility will not be confined to the Middle East: "Increasing interconnectedness will enable individuals to coalesce around common causes across national boundaries, creating new cohorts of the angry, downtrodden, and disenfranchised."

As the report makes clear, these phenomena will have an ever-increasing impact on world affairs. For one thing, the growing uninhabitability of large parts of North Africa, the Middle East, Asia, and Central America will force more and more people to migrate to the cities — producing political and social unrest, as noted — or across international boundaries, to countries less severely affected by climate change and resource scarcity. This surely will produce increased political debate over immigration in receiving countries — and, in all likelihood, an increase in anti-immigrant violence. At the same time, it will complicate the task of combating international terrorist networks that recruit from and hide within immigrant communities in Europe and elsewhere.

New Technologies

Eventually, the report suggests, entrepreneurs and their government backers in the industrialized world will develop new materials and technologies to replace substances in short supply or methods for using them more sparingly. For example, we can expect further improvements in wind and solar power, advanced biofuels, hydrogen fuel-cells, and other alternative energy systems making them more efficient and affordable. This technological revolution will be well underway by 2025 — but not so far advanced as to erase the problems raised by inadequate supplies of oil and natural gas. Also, land and water scarcity will remain a significant worry no matter how much progress is made in other areas. The report's warning of intensified resource strife in 2025 and beyond should, therefore, be read with considerable alarm.

A new report by the National Intelligence Council (NIC) on the emerging strategic landscape, "Global Trends 2025," has attracted worldwide attention because it forecasts a future environment in which the United States wields less power than it does today and must contend with a constellation of other, newly ambitious great powers. "Although the United States is likely to remain the single most important actor," the report notes, "the United States' relative strength — even in the military realm — will decline and U.S. leverage will become more constrained." Of all the many revealing findings in the study, this has been the most widely quoted.

That the United States is likely to experience a decline in its strength relative to other great powers over the next 10 to 15 years is, of course, an observation bound to attract keen attention around the world, where criticism of U.S. foreign policy — over the Iraq War, the handling of the war on terror, our failure to sign the Kyoto Protocol on climate change — remains strong. The fact that "Global Trends 2025" emanated from a U.S. government agency — the NIC is part of the "national intelligence community" and reports to the Director of National Intelligence — lends additional weight to its findings. Still, when all is said and done, it's hardly surprising that professional analysts would come to this conclusion, given the enormous toll on America's military and economic resources taken by five-and-half years of fighting in Iraq and the accompanying loss to our influence, prestige, and goodwill abroad.

Climate and Competition

Far more striking and original, I believe, is the report's emphasis on the role of climate change and resource competition in the world of 2025 and beyond. Until now, these issues have appeared solely on the margins of U.S. strategic and intelligence studies. Now, for the first time, they have moved front and center.

"Resource issues will gain prominence on the international agenda," the NIC report notes. "Unprecedented global economic growth — positive in so many other regards — will continue to put pressure on a number of highly strategic resources, including energy, food, and water, and demand is projected to outstrip easily available supplies over the next decade or so."

The likely future availability of energy and water receives especially close attention. Oil, in particular, is seen as being at risk of failing to meet anticipated world requirements: "Non-OPEC liquid hydrocarbon production — crude oil, natural gas liquids, and unconventionals such as tar sands — will not grow commensurate with demand. Oil and gas production of many traditional energy producers already is declining…Countries capable of significantly expanding production will dwindle; oil and gas production will be concentrated in unstable areas." The bottom line: global oil supplies will be inadequate to satisfy demand, and importing nations will be forced to consume less and/or speed the production of alternatives.

Water scarcity is seen as an equally significant problem: "Lack of access to stable supplies of water is reaching critical proportions, and the problem will worsen because of rapid urbanization worldwide and the roughly 1.2 billion persons to be added [to the world's population] over the next 20 years." At present, we are told, some 600 million people in 21 countries are suffering from inadequate water supplies; by 2025, an estimated 1.4 billion people in 36 countries will face this peril.

Global warming will further exacerbate resource pressures, especially with respect to water and food. Although the impact of climate change will vary from region to region and cannot be predicted with precision, "a number of regions will begin to suffer harmful effects, particularly water scarcity and loss of agricultural production." Some areas will suffer more than others, "with declines disproportionately concentrated in developing countries, particularly those in sub-Saharan Africa." For many of these countries, "decreased agricultural output will be devastating because agriculture accounts for a large share of their economies and many citizens live close to subsistence levels."

Resource Wars

That resource scarcity and climate change will become increasingly severe in the decades ahead are hardly novel observations — many "peak oil" and environmental groups have been saying the same thing for years. But the NIC report takes this one step further by describing how these phenomena will intrude into international affairs and could provide the spark for armed violence. Increased scarcity, it suggests, could lead to greater efforts by states to secure control over overseas sources of energy and other key resources, producing geopolitical struggles among the major energy-deficit nations and possibly provoking all-out war.

"The rising energy demands of growing populations and economies may bring into question the availability, reliability, and affordability of energy supplies," the report notes. "Such a situation would heighten tensions between states competing for limited resources…In the worst case this could lead to interstate conflicts if government leaders deem assured access to energy resources to be essential to maintaining domestic stability and the survival of the regime."

Even in the absence of major interstate conflict, the report argues, growing competition for dwindling energy supplies could lead to heightened tensions, internal conflict, and terrorism. "Even actions short of war will have important geopolitical implications as states undertake strategies to hedge against the possibility that existing energy supplies will not meet rising demands." For example, "energy-deficient states may employ transfers of arms and sensitive technologies and the promise of a political and military alliance as inducements to establish strategic relationships with energy-producing states." Such relationships are already emerging in Central Asia, where China, Russia, and the United States are all competing for access to and control over the region's oil and gas reserves.

The growing concentration of wealth in the hands of petro-elites in places like Angola, Azerbaijan, Kazakhstan, and Nigeria will be another source of potential conflict. Because such elites rarely allocate oil revenues on an equitable basis or allow for a democratic transfer of power, any alteration in national governance (and the distribution of wealth) is likely to be accompanied by violence — often in the form of attacks on pipelines, refineries, and other oil-industry infrastructure. This, in turn, could invite "military intervention by outside powers to stabilize energy flows."

Several areas of the world are likely to figure in energy conflicts of this sort, especially Sub-Saharan Africa, the Middle East, and Central Asia. Each is the site of overlapping lines of conflict produced by a combination of ethnic and religious schisms, internal disputes over the allocation of resource revenues, and the contending geopolitical interests of the major powers. Under these circumstances, it would not take much for a minor skirmish — such as that between Georgia and Russia last August — to escalate into something much greater.

Water and land scarcity brought about or exacerbated by climate change could also trigger armed conflict, suggests the NIC report, although mostly of the internal sort. "Climate change is unlikely to trigger interstate war, but it could lead to increasingly heated interstate recriminations and possibly to low-level armed conflicts." A particular danger zone is the Himalayan region, where the ongoing melting of major glaciers is expected to diminish the annual flow of vital rivers in Bangladesh, China, India, and Pakistan — many of them shared by two or more of these countries and a perennial source of friction among them.

Clusters of Hostility

Terrorist violence will also be spurred by the struggle over critical resources. As climate change and water scarcity renders many rural areas uninhabitable — especially in high-population-growth areas of North Africa, the Middle East, and Asia — hundreds of millions of unemployed young men will pour into the sprawling mega-cities of the developing world, often facing unfriendly reception from the original inhabitants of these areas (who often will be of another religion or ethnicity). Some of these desperate, bitter young men will be drawn to crime; others to militant ideologies and movements.

"As long as turmoil and societal disruptions, generated by resource scarcities, poor governance, ethnic rivalries, or environmental degradation, increase in the Middle East, conditions will remain conducive to the spread of radicalism and insurgencies," the report concludes. And these clusters of hostility will not be confined to the Middle East: "Increasing interconnectedness will enable individuals to coalesce around common causes across national boundaries, creating new cohorts of the angry, downtrodden, and disenfranchised."

As the report makes clear, these phenomena will have an ever-increasing impact on world affairs. For one thing, the growing uninhabitability of large parts of North Africa, the Middle East, Asia, and Central America will force more and more people to migrate to the cities — producing political and social unrest, as noted — or across international boundaries, to countries less severely affected by climate change and resource scarcity. This surely will produce increased political debate over immigration in receiving countries — and, in all likelihood, an increase in anti-immigrant violence. At the same time, it will complicate the task of combating international terrorist networks that recruit from and hide within immigrant communities in Europe and elsewhere.

New Technologies

Eventually, the report suggests, entrepreneurs and their government backers in the industrialized world will develop new materials and technologies to replace substances in short supply or methods for using them more sparingly. For example, we can expect further improvements in wind and solar power, advanced biofuels, hydrogen fuel-cells, and other alternative energy systems making them more efficient and affordable. This technological revolution will be well underway by 2025 — but not so far advanced as to erase the problems raised by inadequate supplies of oil and natural gas. Also, land and water scarcity will remain a significant worry no matter how much progress is made in other areas. The report's warning of intensified resource strife in 2025 and beyond should, therefore, be read with considerable alarm.

Etiketter:

amerikansk udenrigspolitik,

michael klare,

olie

torsdag den 16. oktober 2008

Iraqi Government Fuels 'War for Oil' Theories by Putting Reserves up for Biggest Ever Sale

LONDON - The biggest ever sale of oil assets will take place today, when the Iraqi government puts 40bn barrels of recoverable reserves up for offer in London.

BP, Shell and ExxonMobil are all expected to attend a meeting at the Park Lane Hotel in Mayfair with the Iraqi oil minister, Hussein al-Shahristani.

Access is being given to eight fields, representing about 40% of the Middle Eastern nation's reserves, at a time when the country remains under occupation by US and British forces.

Two smaller agreements have already been signed with Shell and the China National Petroleum Corporation, but today's sale will ignite arguments over whether the overthrow of Saddam Hussein was a "war for oil" that is now to be consummated by western multinationals seizing control of strategic Iraqi reserves.

Al-Shahristani is expected to reveal some kind of "risk service agreements" that could run for up to 20 years, with formal offers to be submitted by next spring and agreements signed in the summer.

Gregg Muttitt, from the UK-based social and ecological justice group Platform, says he is alarmed that the government is pushing ahead with its plans without the support of many in Iraq.

"Most of the terms of what is being offered have not been disclosed. There are security, political and reputational risks here for oil companies but none of them will want to see one of their competitors gain an advantage," he said.

Heinrich Matthee, a senior Middle East analyst at the specialist risk consultant Control Risks Group, also believes there are many pitfalls for those considering whether to make an offer.

"Currently it is unclear which party in Iraq is authorised to award a contract and at the same time to deliver its side of the bargain," he said. "Any contract with an independent oil company will be subjected to opposition and possible revision after pressure by resource nationalists."

Oil companies will find their reputations at risk from the actions of their Iraqi counterparties, such as joint venture partners, suppliers and agents. They will also have to contend with oil smuggling and the possibility that the ruling alliance could collapse, Matthee said.

He said that if the conspiracy theory that western oil companies egged on US and British governments to invade Iraq were true, the plan could backfire on them and benefit rivals in Asia instead. "It is possible the American army has provided the economic stability that will encourage Malaysian, Chinese and other Asian companies to become involved," he said.

There is no precedent for proven oil reserves of this magnitude being offered up for sale, said Muttitt. "The nearest thing would be the post-Soviet sale of the Kashagan field [in the Caspian Sea], which had 7bn or 8bn barrels."

China's state-owned oil group, CNPC, has already agreed a $3bn (£1.78bn) oil services contract with the government of Iraq to pump oil from the Ahdab oil field.

The deal is the first major oil contract with a foreign firm since the US-led war and was followed up by an agreement with Shell, potentially worth $4bn, to develop a joint venture with the South Gas Company in Basra.

This deal has also triggered controversy. Issam al-Chalabi, Iraq's oil minister between 1987 and 1990, questioned why there had been no competitive tendering for the gas-gathering contract and claimed it had gone to Shell as the spoils of war.

"Why choose Shell when you could have chosen ExxonMobil, Chevron, BG or Gazprom?" he asked. "Shell appears to be paying $4bn to get hold of assets that in 20 years could be worth $40bn. Iraq is giving away half its gas wealth and yet this work could have been done by Iraq itself."

The Baghdad government says it aims to increase crude oil production from 2.5m barrels a day to 4.5m by 2013, but faces internal opposition from regional governors and political opponents.

The sale today comes as oil prices have plummeted after stockmarket turmoil on Friday. The price of crude fell by more than $4 at one point to $75 a barrel - the lowest point since September last year and a sharp drop from its peak of $147 in July. Opec, the oil producers' cartel, has called an emergency meeting to agree a cut in output to bolster prices in spite of protestations from politicians including Gordon Brown. Brown said on Friday: "We've had some success in getting the price of oil down: the price this morning is roughly $80, about half what it was a few months ago. I want these price cuts passed on to the consumer as quickly as possible.

"I'm concerned when I hear that the Opec countries are meeting, or are about to meet, to discuss cutting production - in other words, making the price potentially higher than it should be.

"I'm making it clear to Opec it would be wrong for the world economy and wrong for British people who are paying high petrol prices and high fuel prices to cut production and therefore keep prices high."

A government source said: "The one chink of light has been the fall in the price of oil. The last thing we want is to head into a difficult period with a return to high oil prices. People need to act responsibly."

Published on Monday, October 13, 2008 by the Guardian/UK

BP, Shell and ExxonMobil are all expected to attend a meeting at the Park Lane Hotel in Mayfair with the Iraqi oil minister, Hussein al-Shahristani.

Access is being given to eight fields, representing about 40% of the Middle Eastern nation's reserves, at a time when the country remains under occupation by US and British forces.

Two smaller agreements have already been signed with Shell and the China National Petroleum Corporation, but today's sale will ignite arguments over whether the overthrow of Saddam Hussein was a "war for oil" that is now to be consummated by western multinationals seizing control of strategic Iraqi reserves.

Al-Shahristani is expected to reveal some kind of "risk service agreements" that could run for up to 20 years, with formal offers to be submitted by next spring and agreements signed in the summer.

Gregg Muttitt, from the UK-based social and ecological justice group Platform, says he is alarmed that the government is pushing ahead with its plans without the support of many in Iraq.

"Most of the terms of what is being offered have not been disclosed. There are security, political and reputational risks here for oil companies but none of them will want to see one of their competitors gain an advantage," he said.

Heinrich Matthee, a senior Middle East analyst at the specialist risk consultant Control Risks Group, also believes there are many pitfalls for those considering whether to make an offer.

"Currently it is unclear which party in Iraq is authorised to award a contract and at the same time to deliver its side of the bargain," he said. "Any contract with an independent oil company will be subjected to opposition and possible revision after pressure by resource nationalists."

Oil companies will find their reputations at risk from the actions of their Iraqi counterparties, such as joint venture partners, suppliers and agents. They will also have to contend with oil smuggling and the possibility that the ruling alliance could collapse, Matthee said.

He said that if the conspiracy theory that western oil companies egged on US and British governments to invade Iraq were true, the plan could backfire on them and benefit rivals in Asia instead. "It is possible the American army has provided the economic stability that will encourage Malaysian, Chinese and other Asian companies to become involved," he said.

There is no precedent for proven oil reserves of this magnitude being offered up for sale, said Muttitt. "The nearest thing would be the post-Soviet sale of the Kashagan field [in the Caspian Sea], which had 7bn or 8bn barrels."

China's state-owned oil group, CNPC, has already agreed a $3bn (£1.78bn) oil services contract with the government of Iraq to pump oil from the Ahdab oil field.

The deal is the first major oil contract with a foreign firm since the US-led war and was followed up by an agreement with Shell, potentially worth $4bn, to develop a joint venture with the South Gas Company in Basra.

This deal has also triggered controversy. Issam al-Chalabi, Iraq's oil minister between 1987 and 1990, questioned why there had been no competitive tendering for the gas-gathering contract and claimed it had gone to Shell as the spoils of war.

"Why choose Shell when you could have chosen ExxonMobil, Chevron, BG or Gazprom?" he asked. "Shell appears to be paying $4bn to get hold of assets that in 20 years could be worth $40bn. Iraq is giving away half its gas wealth and yet this work could have been done by Iraq itself."

The Baghdad government says it aims to increase crude oil production from 2.5m barrels a day to 4.5m by 2013, but faces internal opposition from regional governors and political opponents.

The sale today comes as oil prices have plummeted after stockmarket turmoil on Friday. The price of crude fell by more than $4 at one point to $75 a barrel - the lowest point since September last year and a sharp drop from its peak of $147 in July. Opec, the oil producers' cartel, has called an emergency meeting to agree a cut in output to bolster prices in spite of protestations from politicians including Gordon Brown. Brown said on Friday: "We've had some success in getting the price of oil down: the price this morning is roughly $80, about half what it was a few months ago. I want these price cuts passed on to the consumer as quickly as possible.

"I'm concerned when I hear that the Opec countries are meeting, or are about to meet, to discuss cutting production - in other words, making the price potentially higher than it should be.

"I'm making it clear to Opec it would be wrong for the world economy and wrong for British people who are paying high petrol prices and high fuel prices to cut production and therefore keep prices high."

A government source said: "The one chink of light has been the fall in the price of oil. The last thing we want is to head into a difficult period with a return to high oil prices. People need to act responsibly."

Published on Monday, October 13, 2008 by the Guardian/UK

Etiketter:

Irak-krigen,

olie

lørdag den 4. oktober 2008

Irak-krigen -> Dollarens hegemoni på olie-markedet.

Følgende er et uddrag fra min artikel 'Fogh & Bush - Venner i Ilden.' som jeg finder interessant at perspektivere til, i lyset af kapiliberalismens $millard-bailout af Wall Street spekulanter for skattemidler, da denne krise også bør ses i lyset af den ekstremt omkostningstunge Irak-krig, og dennes årsag.

Uddrag:

Uddrag:

Olien og dollaren…

Efter Anden Verdenskrig lå store dele af den europæiske og japanske industri hen i ruiner, og produktionen befandt sig generelt på et lavt niveau. USA var den eneste af de store magter, som undslap krigens ødelæggelser, og den amerikanske industri var efter krigen højproduktiv, således at man under krigen tredoblede produktionen indenrigs.

Derudover flyttedes store mængder guld fra Europa til USA før og under anden verdenskrig grundet det økonomiske og politiske postyr på det europæiske kontinent. Efter Anden Verdenskrig var USA således indehaver af 80 pct. af verdens guld og man rådede samtidig over 40 pct. af verdens samlede produktionsapparat. En fast valutakurs etableredes kaldet gulddollar standarden, hvor guldet blev prissat til $35 pr. ounce.

Guld blev altså ækvivalent med dollaren, og den amerikanske valuta blev efterfølgende den internationale valutareservestandard. Derudover bør det nævnes, at præsident Franklin Delano Roosevelt i 1945 lavede en aftale med den saudi-arabiske Ibn Saud gående ud på, at man ville beskytte landet, mod at regimet kun handlede dets olie i dollars [15]. Disse to historiske forhold er meget væsentlige at have med, hvis man vil forstå, hvorfor den internationale oliehandel har været domineret af dollaren i adskillelige årtier, hvilket ses manifesteret i det faktum, at olie kun kan købes hos OPEC i dollars.

Denne dollar-dominans blev af Saddam Hussein truet, da han i september 2000 valgte at veksle sin dollarreserve til euros [16] med henblik på at handle den irakiske olie i denne valuta, og det blev efterfølgende af flere olie-producerende lande hævdet, at man havde lignende intentioner, hvilket for Irans vedkommende i dag ses manifesteret i landets for nyligt lancerede eurobaserede oliebørs.

Det amerikanske olieforbrug forventes fra officiel side, at stige med en tredjedel over de næste to årtier, mens produktionen indenrigs forventes at falde med 12 pct. i samme periode, hvorfor den amerikanske afhængighed af importeret olie er steget fra at udgøre en tredjedel af forsyningen i 1985 til i dag at udgøre mere end halvdelen, og det forventes ydermere at importeret olie vil udgøre to tredjedele af forsyningen i 2020. Selvom man har gjort, hvad man kan for at sikre forsyningsstabiliteten, blandt andet ved at handle olie med lande uden for OPEC, var OPEC (primært Saudi-Arabien) fortsat den største eksportør af olie til USA i 2002-2003 [17].

Præsident Bush og vicepræsident Dick Cheney var blot de første eksempler på administrations dybe forbindelser til energisektoren. Otte ministre samt den nationale sikkerhedsrådgiver blev senere hentet direkte i oliebranchen. Præsidenten udpegede to uger inde i hans embede vice-præsident Dick Cheney som overhoved for task forcet National Energy Policy Group, hvis formål var en vurdering af karakteren af den amerikanske forsyningssikkerhed.

Et faktum som næppe kan have undgået Cheney’s Task Force’s opmærksomhed er, at der i Det Kaspiske Hav og under den irakiske ørken potentielt er 433 milliarder tønder olie eller mere, og kontrol over denne olie er selvsagt ensbetydende med øget økonomisk og geopolitisk magt. Bemærkelsesværdigt er det derfor også, at dette Task Force allerede mange måneder inden den 11. september, undersøgte kort over irakiske oliefelter, tankerterminaler og olieudvinding. Disse kort er først langt senere blevet offentliggjort grundet at sagsanlæg mod regeringen vedrørende aktindsigt som borgerretsgruppen Judicial Watch måtte hele vejen til Højesteret for at vinde [18].

Cheney’s taskforce konkluderede, at efter »enhver vurdering vil mellemøstlige olieproducenter forblive centrale for sikkerheden i verden. Golfområdet vil være et primært fokus for USA’s internationale energipolitik«. [19]

Samtidig med dette blev Condeoleeza Rice’s National Security Council beordret, at det skulle støtte »gennemgangen af operationelle politikker rettet mod slyngelstater såsom Irak, samt handlinger vedrørende pågribelsen af nye og eksisterende olie og gasfelter«.

I statsministeriet etableredes et såkaldt policy-development initiativ, der blev døbt »The Future of Iraq«. I initiativets sidste rapport gjordes det klart at Irak »burde åbnes for internationale olieselskaber så hurtigt som muligt efter krigen ... landet bør etablere et forretningsklima som kan bidrage med at tiltrække investeringer i olie- og gasressourcer«. [20]

Disse forhold peger alle sammen hen imod, at Bush-administration var overordentlig interesseret i den irakiske olie lang tid før proklameringen og markedsføringen af den Globale Krig mod Terror, og selvom det fra officiel side gentagne gange er blevet hævdet, at angrebskrigen intet havde at gøre med olie, er der et interessant forhold, som indikerer det modsatte. I en artikel i Financial Times den 5. juni 2003 - altså allerede mindre end tre måneder efter krigens begyndelse – kunne man læse, at den irakiske olie igen handledes i dollars [21], til trods for at euroen i midten af 2003 havde en 13 pct. højere værdi end dollaren.

Krigens omfattende økonomiske omkostninger.

Ifølge det officielle organ US Census Bureau havnede yderligere 3,5 millioner amerikanere i fattigdom i perioden 2002-2006, hvilket i dag betyder, at rundt regnet 13 pct. af den amerikanske befolkning er fattige. Denne foruroligende stigning i fattigdom er specielt bemærkelsesværdig, når den ses i sammenhæng med de enorme omkostninger, som Irak-krigen har kostet de amerikanske skatteydere.

Fra officiel side vurderede man før Irak-krigen påbegyndtes, at krigen ville koste omtrent 60 milliarder dollars, men dette må i lyset af krigsomkostningerne på nuværende tidspunkt betegnes som en meget optimistisk vurdering. Joseph Stieglitz, en af USA’s ledende økonomer, som i 2000 modtog Nobelprisen i økonomi og som tidligere har været cheføkonom i Verdensbanken, har netop i en ny bog vurderet, at den egentlige pris for Irak-krigen oprinder i tre billioner (på amerikansk kaldet trillion) dollars, hvilket Stieglitz i et interview sendt på Democracy Now den 29. februar i år, selv kalder en forholdsvis konservativ vurdering.

Ifølge Stieglitz er der nemlig udover forsvarsministeriets budgetterede krigsomkostninger, endvidere en lang række omkostninger skjult i andre offentlige budgetter og hinsides disse. For eksempel vil udgifter til de økonomiske kompensationer til tilskadekomne krigsveteraner, samt udgifter til medicinsk behandling af disse, løbe op i mange hundrede milliarder dollars over de kommende årtier. Hinsides disse budgetmæssige omkostninger findes der derudover andre skjulte omkostninger for økonomien.

Således udgør invaliderede soldaters økonomiske godtgørelser kun en brøkdel af de invalideredes familier økonomiske tab i form af tabte indkomster, som soldaterne ellers kunnet have tjent. Derudover er der ifølge Stieglitz en lang række makroøkonomiske omkostninger, som har forvoldt en deprimering af økonomien, såsom det faktum at krigen har bidraget til stigningen i prisen på olie, hvilket betyder ekstraomkostninger til køb af importeret olie, og følgelig at disse penge ikke kan bruges andetsteds i økonomien. Derudover nævner Stieglitz det forhold, at krigen var fuldstændig finansieret for lånte penge, altså med andre ord, af det enorme amerikanske underskud [22].

Etiketter:

amerikansk udenrigspolitik,

finanskrisen,

Irak-krigen,

olie

tirsdag den 18. september 2007

Woodward: Greenspan Ouster Of Hussein Crucial For Oil Security

"Greenspan, who was the country's top voice on monetary policy at the time Bush decided to go to war in Iraq, has refrained from extensive public comment on it until now, but he made the striking comment in a new memoir out today that "the Iraq War is largely about oil." In the interview, he clarified that sentence in his 531-page book, saying that while securing global oil supplies was "not the administration's motive," he had presented the White House with the case for why removing Hussein was important for the global economy."

"I was not saying that that's the administration's motive," Greenspan said in an interview Saturday, "I'm just saying that if somebody asked me, 'Are we fortunate in taking out Saddam?' I would say it was essential."

http://www.washingtonpost.com/wp-dyn/content/article/2007/09/16/AR2007091601287.html

"I was not saying that that's the administration's motive," Greenspan said in an interview Saturday, "I'm just saying that if somebody asked me, 'Are we fortunate in taking out Saddam?' I would say it was essential."

http://www.washingtonpost.com/wp-dyn/content/article/2007/09/16/AR2007091601287.html

mandag den 17. september 2007

Greenspan: Irak-krig handlede om olie

Abonner på:

Kommentarer (Atom)