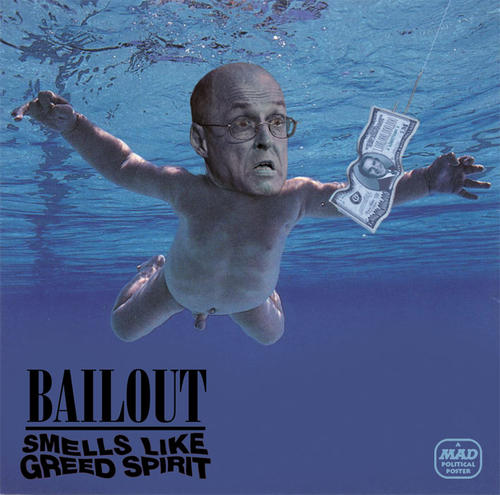

Any subsidies eventually given to the monster banks of Wall Street will be as American as apple pie and obesity. The sums demanded may be unprecedented, but there is nothing new about the principle: corporate welfare is a consistent feature of advanced capitalism. Only one thing has changed: Congress has been forced to confront its contradictions.

One of the best studies of corporate welfare in the US is published by my old enemies at the Cato Institute. Its report, by Stephen Slivinski, estimates that in 2006 the federal government spent $92bn subsidising business. Much of it went to major corporations such as Boeing, IBM and General Electric.

The biggest money crop - $21bn - is harvested by Big Farmer. Slivinski shows that the richest 10% of subsidised farmers took 66% of the payouts. Every few years, Congress or the administration promises to stop this swindle, then hands even more state money to agribusiness. The farm bill passed by Congress in May guarantees farmers a minimum of 90% of the income they've received over the past two years, which happen to be among the most profitable they've ever had. The middlemen do even better, especially the companies spreading starvation by turning maize into ethanol, which are guzzling billions of dollars' worth of tax credits.

Slivinski shows how the federal government's Advanced Technology Program, which was supposed to support the development of technologies that are "pre-competitive" or "high risk", has instead been captured by big businesses flogging proven products. Since 1991, companies such as IBM, General Electric, Dow Chemical, Caterpillar, Ford, DuPont, General Motors, Chevron and Monsanto have extracted hundreds of millions from this programme. Big business is also underwritten by the Export-Import Bank: in 2006, for example, Boeing alone received $4.5bn in loan guarantees.

The government runs something called the Foreign Military Financing programme, which gives money to other countries to purchase weaponry from US corporations. It doles out grants to airports for building runways and to fishing companies to help them wipe out endangered stocks.

But the Cato Institute's report has exposed only part of the corporate welfare scandal. A new paper by the US Institute for Policy Studies shows that, through a series of cunning tax and accounting loopholes, the US spends $20bn a year subsidising executive pay. By disguising their professional fees as capital gains rather than income, for example, the managers of hedge funds and private equity companies pay lower rates of tax than the people who clean their offices. A year ago, the House of Representatives tried to close this loophole, but the bill was blocked in the Senate after a lobbying campaign by some of the richest men in America.

Another report, by a group called Good Jobs First, reveals that Wal-Mart has received at least $1bn of public money. Over 90% of its distribution centres and many of its retail outlets have been subsidised by county and local governments. They give the chain free land, they pay for the roads, water and sewerage required to make that land usable, and they grant it property tax breaks and subsidies (called tax increment financing) originally intended to regenerate depressed communities. Sometimes state governments give the firm straight cash as well: in Virginia, for example, Wal-Mart's distribution centres receive handouts from the Governor's Opportunity Fund.

Corporate welfare is arguably the core business of some government departments. Many of the Pentagon's programmes deliver benefits only to its contractors. Ballistic missile defence, for example, which has no obvious strategic purpose and is unlikely ever to work, has already cost the US between $120bn and $150bn. The US is unique among major donors in insisting that the food it offers in aid is produced on its own soil, rather than in the regions it is meant to be helping. USAid used to boast on its website that "the principal beneficiary of America's foreign assistance programs has always been the United States. Close to 80% of the USAid's contracts and grants go directly to American firms." There is not and has never been a free market in the US.

Why not? Because the congressmen and women now railing against financial socialism depend for their re-election on the companies they subsidise. The legal bribes paid by these businesses deliver two short-term benefits for them. The first is that they prevent proper regulation, allowing them to make spectacular profits and to generate disasters of the kind Congress is now confronting. The second is that public money that should be used to help the poorest is instead diverted into the pockets of the rich.

A report published last week by the advocacy group Common Cause shows how bankers and brokers stopped legislators banning unsustainable lending. Over the past financial year, the big banks spent $49m on lobbying and $7m in direct campaign contributions. Fannie Mae and Freddie Mac spent $180m in lobbying and campaign finance over the past eight years. Much of this was thrown at members of the House financial services committee and the Senate banking committee.

Whenever congressmen tried to rein in the banks and mortgage lenders they were blocked by the banks' money. Dick Durbin's 2005 amendment seeking to stop predatory mortgage lending, for example, was defeated in the Senate by 58 to 40. The former representative Jim Leach proposed re-regulating Fannie Mae and Freddie Mac. Their lobbyists, he recalls, managed in "less than 48 hours to orchestrate both parties' leadership" to crush his amendments.

The money these firms spend buys the socialisation of financial risk. The $700bn the government was looking for was just one of the public costs of its repeated failure to regulate. Even now the lobbying power of the banks has been making itself felt: on Saturday the Democrats watered down their demand that the money earned by executives of companies rescued by the government be capped. Campaign finance is the best investment a corporation can make. You give a million dollars to the right man and reap a billion dollars' worth of state protection, tax breaks and subsidies. When the same thing happens in Africa we call it corruption.

European governments are no better. The free market economics they proclaim are a con: they intervene repeatedly on behalf of the rich, while leaving everyone else to fend for themselves. Just as in the US, the bosses of farm companies, oil drillers, supermarkets and banks capture the funds extracted by government from the pockets of people much poorer than themselves. Taxpayers everywhere should be asking the same question: why the hell should we be supporting them?

Kilde: http://www.guardian.co.uk/commentisfree/2008/sep/30/marketturmoil.subprimecrisis

Endvidere kan man læse denne artikel [kilde angivet nedenfor]med titlen Bailing out the market hvori William Pentland skriver:

While everyone knows the U.S. government is looking to bail Wall Street banks, few people realize that it's also bailing out speculative oil and commodities traders in the process, fueling a sharp rise in energy prices. Lehman Brothers (nyse: LEH - news - people ) and AIG (nyse: AIG - news - people ) held enormous trading positions in commodities markets. If those positions had been liquidated suddenly, the price of everything from wheat to oil would have collapsed. The Commodity Futures Trading Commission, the main regulator of U.S. commodity markets, allowed Wall Street's investment banks and trading companies to take control of massive positions in commodities markets called swaps held by Lehman Brothers and AIG.

The result: Oil prices spiked by a whopping $16 per barrel on Monday, the largest single-day rise in oil prices ever.

"If speculators were forced to liquidate their positions, oil would easily be $65 to $75 per barrel by the time the liquidation was complete," said Michael Masters, the founder of Atlanta-based hedge fund Masters Capital Management. Tuesday, oil was trading at $108.74 in midday trading in New York.

For all the talk of OPEC, the biggest threat to high oil prices in the short term might be the implosion of Morgan Stanley (nyse: MS - news - people ) or Goldman Sachs (nyse: GS - news - people ), which would trigger a massive number of low-priced oil-futures contracts to flood the market all at once in search of buyers to liquidate those contracts.

"If either of these entities were to collapse, we believe the downside for commodities would be tremendous as these companies unwind positions," Valerie Wood, president and owner of Energy Solutions, told Platts on Monday. "In particular, we know Goldman Sachs has large investments in crude oil and natural gas commodities because its own Goldman Sachs Commodity Index fund [comprises] about 39% crude oil commodities and about 6% natural gas commodities. A liquidation of GSCI shares would directly result in the selling of these commodities, and selling pushes prices lower."

Ironically, the biggest losers turned out to be the traders who bet that at least one of the victims from this month's financial chaos would be forced to liquidate a major long position in oil prices. When they avoided that fate, the race to unwind those bets that oil prices would fall before the end of the trading month caused a massive rally in oil prices.

The market meltdown has revealed the full extent of Wall Street's influence on commodities prices and, especially, their role in energy markets. More than $40 billion in cash has poured into commodity markets since the start of 2008, according to a report by Standard & Poor's. The total amount of investments in commodity indexes is estimated at between $150 billion and $270 billion. In other words, new investments in the market have climbed by 15% to 25% in less than a year.

In 2006, the U.S. Senate's Subcommittee for Permanent Investigations had already reported "there is substantial evidence supporting the conclusion that the large amount of speculation in the current market has significantly increased prices." The trouble is that so much of the trading happens in so-called "dark markets," unregulated over-the-counter electronic exchanges where trading companies buy and sell energy derivatives, that this role is hard to document.

Investment banks make money off commodities speculation, but are just conduits for hedge funds and institutional investors that have taken large positions in commodities markets as a long-term investment.

"The market dynamics induced more and more financial players to move into commodities markets," said Fadel Gheit, a senior oil analyst at Oppenheimer & Co. "It was a perfect storm. The Federal Reserve was cutting interest rates and people were running away from the dollar as it lost value. Hedge funds, pension funds and mutual funds started pumping money into commodities because they were the safest place and the safest of them all was crude oil. There were too many dollars chasing too few physical assets. That's the bottom line."

http://www.forbes.com/home/2008/09/23/energy-oil-washington-biz-cx_wp_0923energy.html